From SPPG to PPPK: The Dynamics of Program-Based Staffing in Indonesia’s Civil Service Reform

The government’s decision to appoint personnel from the Nutrition Fulfillment Service Unit (SPPG) as Government Employees with Work Agreements (PPPK),…

The lively atmosphere of Gamping Market, Yogyakarta, had begun to fade that morning. Several stalls stood empty as their owners, who had been working since 1 a.m., had already left. Only the “morning class” vendors had just arrived. Nestled between a wholesale orange juice seller and a fresh fish stall was a spice and grocery shop still bustling with customers, mostly food vendors from around Muhammadiyah University Yogyakarta.

The shop owner deftly calculated purchases while answering questions. Once he mentioned the total, instead of reaching for banknotes, his loyal customer pulled out a smartphone. In less than a minute, the payment was complete. Uniquely, there was no physical exchange of cash—only an invisible transfer from buyer to seller via Quick Response Indonesian Standard (QRIS).

QRIS has spread across almost every sector: large retailers, service providers, restaurants, transportation, and even street vendors. It reflects the younger generation’s preference for cashless transactions. Tourists also find QRIS convenient during their stay in Indonesia.

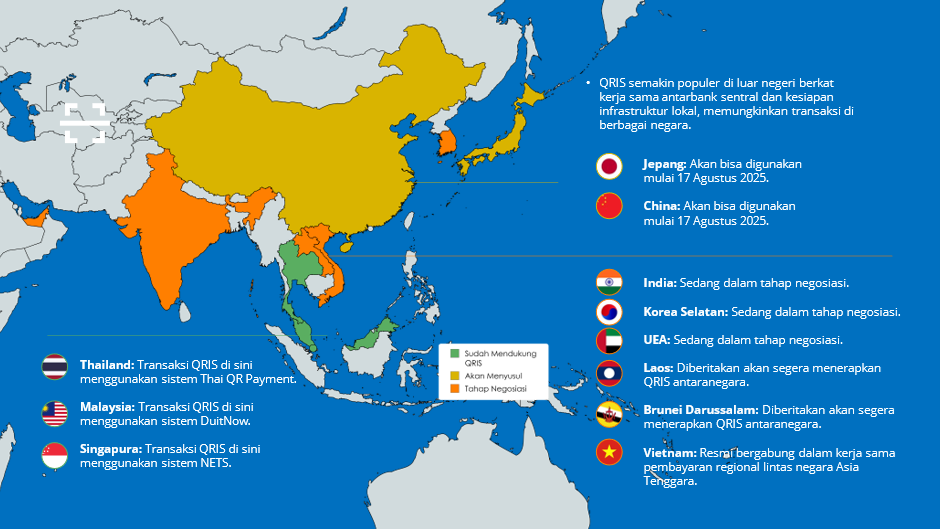

Indeed, amid the nation’s struggles, Indonesians can take pride in this Bank Indonesia innovation. QRIS is not only popular domestically but also in Singapore, Thailand, and Malaysia. On August 17, 2025, as an Independence Day gift, QRIS launched in China and Japan, two highly regulated financial systems.

Japan’s Ambassador to Indonesia, Masaki Yasushi, even praised QRIS as more advanced than Japan’s own system:

“QRIS is one of Indonesia’s best tools. If Indonesians can use it in Japan, it will make their travel and stay much easier,” he told Republika.

Tourists from Thailand, Malaysia, and Singapore expressed similar admiration. Bank Indonesia’s Bali office confirmed QRIS allowed them to pay using their home platforms without currency exchange.

In Bali alone, foreign tourists from the three countries made 31,455 transactions worth Rp 7.1 billion. Nationwide in 2024, transactions from these tourists reached 1.17 million worth Rp 288.4 billion.

Deputy Head of BI Bali Office, Butet Linda Helena Panjaitan, said QRIS boosts SMEs: of the 39.3 million registered merchants, 93.16% are SMEs. For them, QRIS is simple—just a QR code printed or displayed on a phone, enabling payments from multiple banks and e-wallets. Currently, 56 million QRIS users and 38 million merchants exist, with most transactions under Rp 500,000.

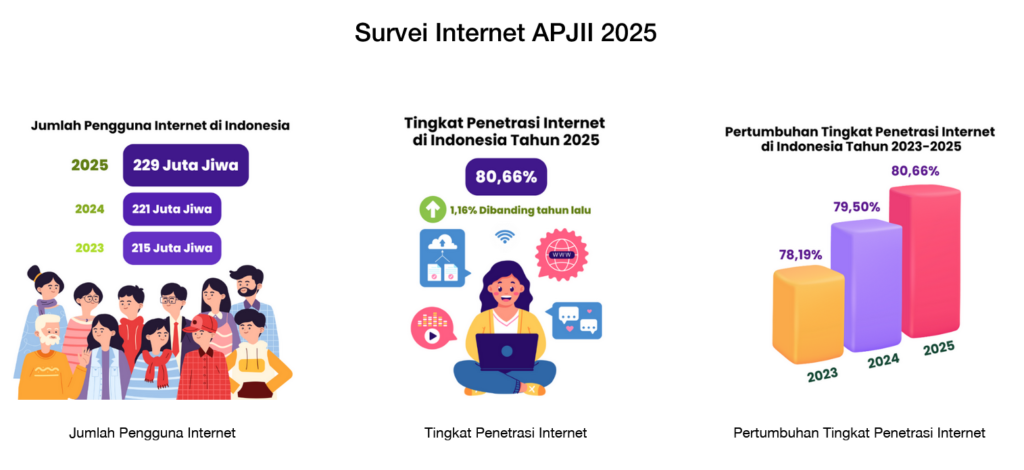

QRIS penetration is supported by rising smartphone use, wider internet coverage, and youth cashless preferences. According to APJII, internet penetration reached 80.66% of the population in 2025 (229 million people). The highest was in Java (84.69%), followed by Kalimantan, Sumatra, Bali-Nusa Tenggara, Sulawesi, and Maluku-Papua.

Indonesia also ranks 4th globally in smartphone users (187.7 million). QRIS transactions grew 148.5% year-on-year (June 2025), aligning with non-cash transaction growth from Rp 22.14 trillion in 2019 to Rp 303.19 trillion in H1 2024.

According to Bank Indonesia, QRIS is now interoperable in five countries: Malaysia, Thailand, Singapore, China, and Japan.

In China, four Indonesian switching providers (Alto, Artajasa, Jalin, Rintis) partnered with UnionPay International. Negotiations are ongoing with India (NPCI) and South Korea (KFTCI). Saudi Arabia is also targeted, given Indonesia sends 200,000 Hajj pilgrims annually.

These partnerships focus on tourist flows and migrant worker destinations. For instance, China was Indonesia’s largest tourist source in 2024 (1.19 million visitors), while Japan is a top destination for migrant workers.

Despite its success, QRIS faces challenges, notably fraudulent codes. Fake QR codes mimic legitimate merchants, diverting payments to fraudsters.

A notorious 2023 case involved 38 mosques in Jakarta, where a fraudster installed fake QRIS codes, stealing Rp 13 million. Another case saw a gelato shop lose Rp 45 million when staff used personal QRIS.

Economist Nailul Huda (Indef) called these frauds a sign that the system needs improvement. Policymakers acknowledge QRIS fraud remains a key problem.

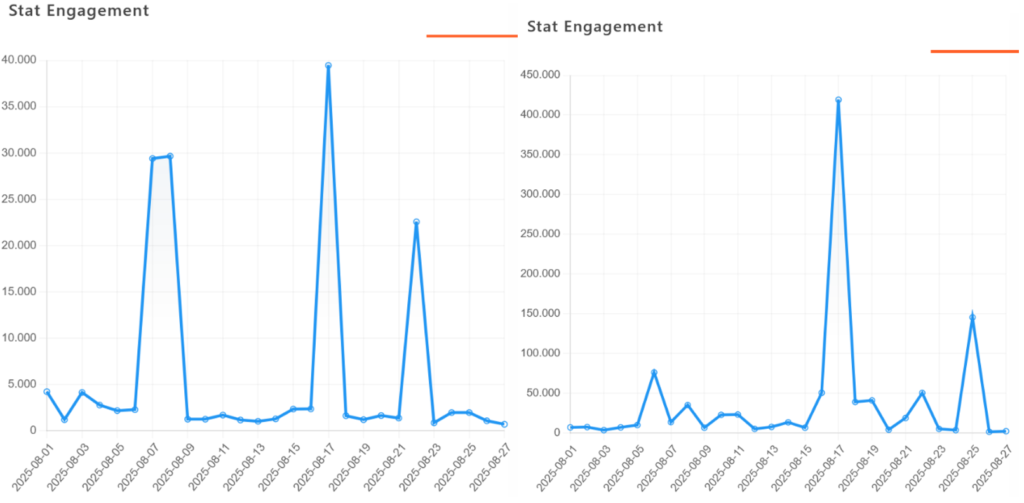

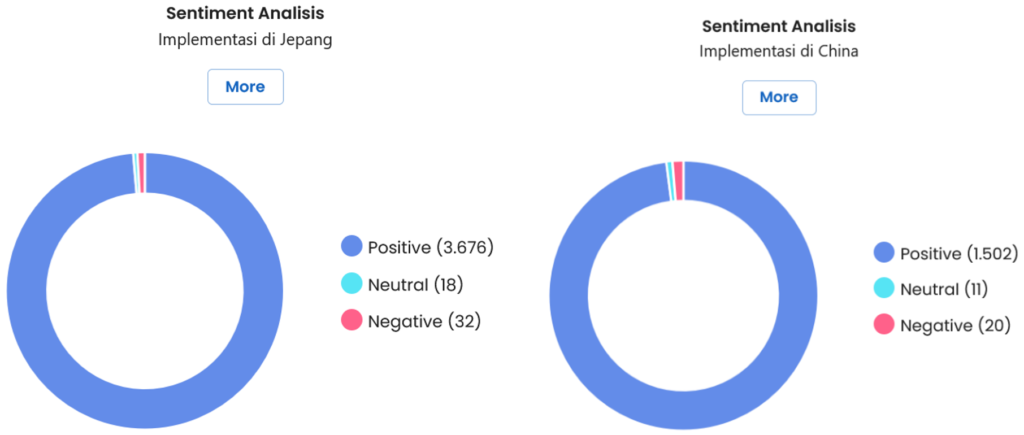

QRIS has become a source of national pride. Social media analytics tool Socindex recorded a surge in engagement on Aug 17, 2025, tied to QRIS launches in Japan and China.

Content celebrating QRIS in Japan went viral. Folkative’s Instagram post gained 398,000 likes, while @IndoPopBase’s X post reached 30,000 likes.

Media coverage was also massive. Newstensity recorded 20,148 news articles mentioning QRIS (Aug 1–27, 2025). QRIS in Japan made up 18.49% (3,726 articles); in China 7.6% (1,533 articles). Sentiment was overwhelmingly positive.

QRIS is one of Indonesia’s most celebrated local innovations. Its future potential is vast, especially in migrant worker destinations like Hong Kong, Taiwan, and the Middle East. Yet fraud prevention must be prioritized.

QRIS demonstrates that Indonesia’s payment digitalization is on the right path, bridging traditional markets and global financial ecosystems.

Writer: Khoirul Rifai (Jangkara), Ilustrator: Aan K. Riyadi

The government’s decision to appoint personnel from the Nutrition Fulfillment Service Unit (SPPG) as Government Employees with Work Agreements (PPPK),…

The evolution of marketing over the past few years has shown a major shift, especially as digital marketing becomes the…

Freedom of opinion and expression is a constitutional right protected by law. Today, the public’s channel for voicing disappointment toward…

In January 2026, the internet was shaken by the viral spread of a book titled “Broken Strings: Fragments of a…

The government has begun outlining the direction of the 2026 State Budget (APBN 2026) amid ongoing global economic uncertainty. Finance…

The Indonesian government, through the Ministry of Communication, Information, and Digital Affairs (Komdigi), has officially temporarily blocked the use of…

A few years ago, electric cars still felt like a far-off future. They were seen as expensive, futuristic in design,…

Hydrometeorological disasters hit three provinces in Sumatra—Aceh, North Sumatra, and West Sumatra. Tropical Cyclone Senyar, spinning in the Malacca Strait,…

The heavy rainfall in late November 2025 caused flash floods that submerged parts of Aceh, West Sumatra, and North Sumatra….

When we consider people’s decisions today—what to buy, what issues to trust, and which trends to follow—one thing often triggers…