From SPPG to PPPK: The Dynamics of Program-Based Staffing in Indonesia’s Civil Service Reform

The government’s decision to appoint personnel from the Nutrition Fulfillment Service Unit (SPPG) as Government Employees with Work Agreements (PPPK),…

Over the past few decades, growing awareness of sustainability has reshaped the way companies and investors evaluate business performance. Rising environmental threats, the demand for social welfare, and calls for transparent governance have fostered the ESG framework—Environmental, Social, Governance. Rather than replacing traditional financial statements, ESG complements them by mapping non-financial risks that can affect a firm’s value and reputation.

For investors, ESG opens a new window on long-term opportunity. For corporations, it offers a strategic tool to strengthen branding, comply with global regulations, and attract capital at more competitive rates. This brief explains ESG in plain language, outlines its business functions, and shows how it is applied in the media-monitoring industry.

ESG is a measurement framework for the environmental, social, and governance impacts and risks of an organization—essentially anything that falls outside pure financial data.

Focuses on greenhouse-gas emissions, waste management, resource efficiency, and climate risk. The Task Force on Climate-related Financial Disclosures (TCFD) links climate variables to financial risk, while the Global Reporting Initiative (GRI) supplies the world’s most widely used environmental-reporting standards.

Covers a firm’s relationship with employees (wages, safety), local communities, and end-users. In an era of critical consumers, corporate reputation often hinges on how well a company treats its people, suppliers, and neighbors.

Centers on board structure, oversight mechanisms, business ethics, and shareholder rights. Decision-making transparency, anti-corruption policies, and executive pay all fall under this pillar.

PwC notes that companies integrating all three pillars enjoy a stronger competitive edge with stakeholders.

Early warning system – ESG highlights crises that standard financials may miss. Unethical supply-chain practices, for instance, can trigger consumer boycotts or legal action long before the damage hits the balance sheet.

Opportunity engine – Investing in renewable energy, water efficiency, or community empowerment can unlock new markets and trim operating costs.

Investor signal – Pension funds and global lenders now prioritize high-ESG assets. Companies with strong scores often secure lower borrowing costs and broader access to capital.

PwC’s 2023 Global Investor Survey found that 79 percent of investors view ESG as crucial to decision-making—yet 94 percent suspect corporate sustainability reports contain unsubstantiated claims (green-washing).

In today’s digital landscape, ESG issues move reputations. The torrent of online and social-media content demands not only ethical action but savvy perception management.

Traditional clipping services are no longer enough; firms need deep analysis that gauges ESG impact against global standards such as GRI. Newstensity answers that need by combining AI with real-time media monitoring:

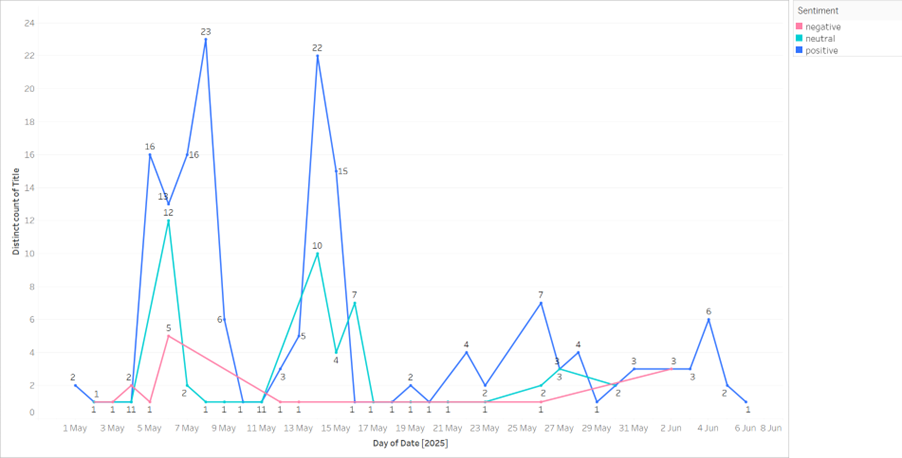

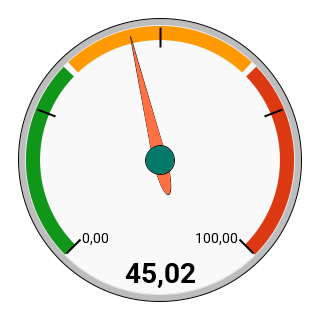

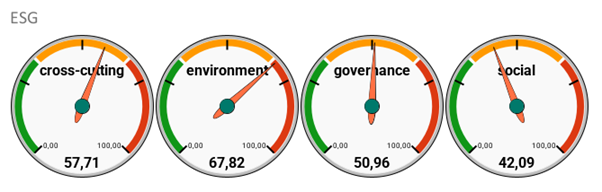

During May Indika generated 134 ESG-related stories with a composite index of 45.02—placing the company in the Safe (BB) zone, though vigilance is still advised. Positive coverage dominated, linking Indika to the national shift toward green business and infrastructure in eastern Indonesia.

A closer look shows the Environmental pillar’s highest-risk issue was resource efficiency and conservation, tied to coverage of subsidiary Interport and its logistics expansion. The risk spike arose not from negative sentiment but from low-credibility sources: 15 of the 19 articles came from unverified regional portals, inflating the index.

Implication – Indika’s reputation was healthy overall, yet the firm could reinforce its positive narrative by partnering with verified, higher-credibility outlets.

In a world of complex environmental and social challenges, ESG serves as a strategic compass. When businesses and investors grasp its meaning, function, and analytical use—especially through modern media-monitoring platforms—they can align action with public expectation and sustainability goals.

Writer: Fajar Yudha Susilo, Ilustrator: Aan K. Riyadi

The government’s decision to appoint personnel from the Nutrition Fulfillment Service Unit (SPPG) as Government Employees with Work Agreements (PPPK),…

The evolution of marketing over the past few years has shown a major shift, especially as digital marketing becomes the…

Freedom of opinion and expression is a constitutional right protected by law. Today, the public’s channel for voicing disappointment toward…

In January 2026, the internet was shaken by the viral spread of a book titled “Broken Strings: Fragments of a…

The government has begun outlining the direction of the 2026 State Budget (APBN 2026) amid ongoing global economic uncertainty. Finance…

The Indonesian government, through the Ministry of Communication, Information, and Digital Affairs (Komdigi), has officially temporarily blocked the use of…

A few years ago, electric cars still felt like a far-off future. They were seen as expensive, futuristic in design,…

Hydrometeorological disasters hit three provinces in Sumatra—Aceh, North Sumatra, and West Sumatra. Tropical Cyclone Senyar, spinning in the Malacca Strait,…

The heavy rainfall in late November 2025 caused flash floods that submerged parts of Aceh, West Sumatra, and North Sumatra….

When we consider people’s decisions today—what to buy, what issues to trust, and which trends to follow—one thing often triggers…