SEAblings: A Unique Show of Southeast Asian Netizen Solidarity

Lately, the term SEAblings has been widely discussed across social media. The phenomenon gained traction after tensions between Southeast Asian…

Indonesia’s long “fintech-lending winter” has claimed another major player. Peer-to-peer (P2P) platform PT Akseleran Keuangan Inklusif Indonesia – better known as Akseleran – is struggling to repay lenders after six corporate borrowers defaulted on a combined Rp 178.27 billion (about US$10.8 million).

The setback places Akseleran alongside troubled rivals Crowde, Tanifund, KoinP2P and the now-liquidated pioneer Investree, deepening public anxiety over the health of Indonesia’s fast-growing P2P sector.

Akseleran disclosed on March 3, 2025 that simultaneous defaults had hit six affiliated borrowers:

| Borrower | Sector | Outstanding loan (Rp billion) |

|---|---|---|

| PT PDB | Defense-equipment supplier | 42.30 |

| PT EFI | EPC contractor | 46.55 |

| PT PPD | Sand & gravel supplier | 59.04 |

| PT CPM | Interior contractor | 9.58 |

| PT ABA | Construction firm | 15.54 |

| PT IBW | Furniture manufacturer | 5.25 |

Several defaulters were subcontractors on state-owned-enterprise (SOE) projects and blame late government payments for their cash-flow crunch. PT EFI, for instance, cites delayed retention money on a fertilizer-plant EPC job in Aceh, while PT PPD says its contract on the Semarang–Demak toll road was terminated before it could be paid for materials already supplied. Akseleran has begun legal action in the latter case.

As of March 2025, the Financial Services Authority (OJK) listed 97 licensed fintech-lending firms; 19 showed dangerously high 90-day default ratios (TWP90).

High-profile collapses include:

Investree – License revoked Oct 21 2024; co-founder Adrian Gunadi named fraud suspect; liquidation approved Mar 14 2025.

Tanifund – Liquidated after default wave in early 2024.

Crowde & KoinP2P – Facing police reports over alleged fund misuse and borrower fraud.

All cases share one trait: cascading borrower arrears that stranded lenders’ principal and interest. In Investree’s saga, super-lenders who placed up to Rp 1 billion each were left in limbo.

Although defaults began in March, the story stayed largely within investor circles until mid-June. One retail lender, @anitacarolina612, posted TikTok videos lamenting Rp 472 million stuck across five bad loans.

Unlike some peers, Akseleran kept communication channels open – meeting investors, hosting Zoom briefings and outlining an insurance back-stop that covers 75–99 percent of loan principal (subject to policy limits). Even so, with TKB90 (the industry’s on-time repayment metric) slumping to 44.85 percent by June 23, liquidity remains “dangerous,” analysts say.

Akseleran had posted its first annual profit (Rp 3.74 billion) in 2024 and kept TWP90 below 1 percent—until the six defaults shattered the streak.

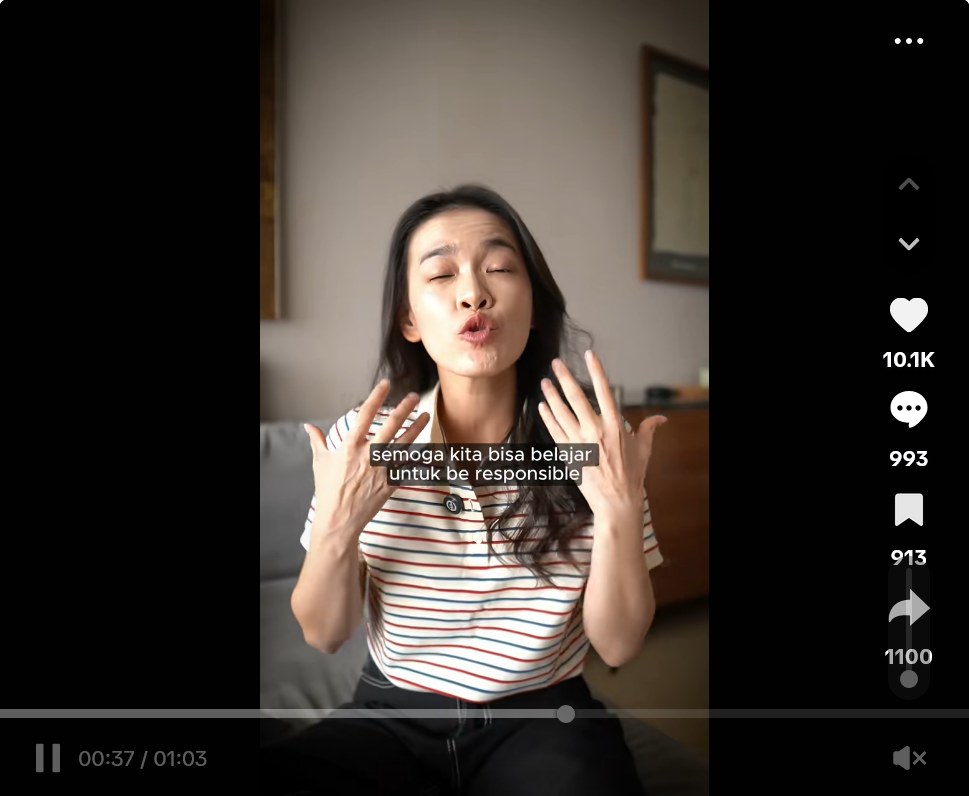

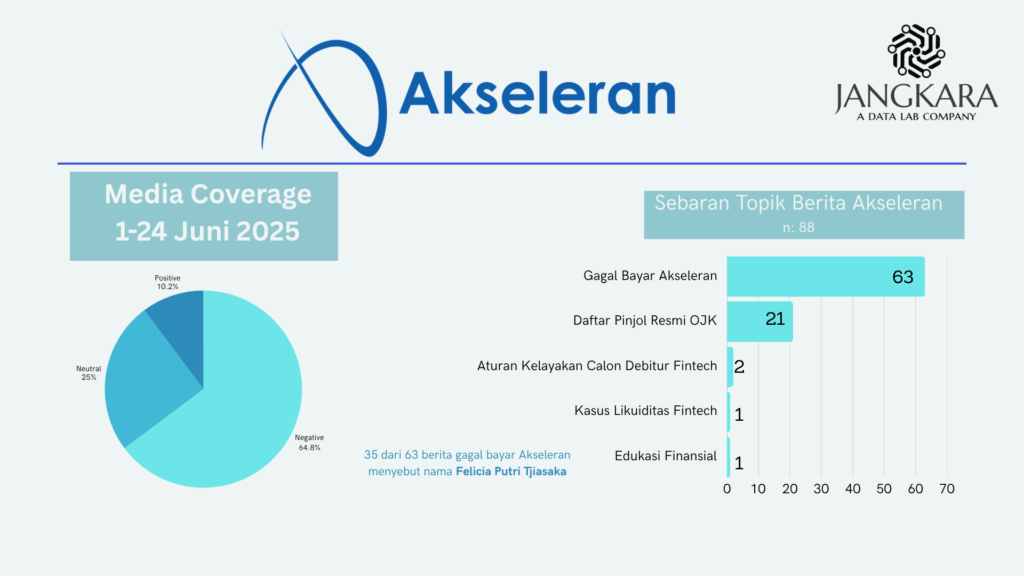

The crisis exploded on June 20 when finance influencer Felicia Putri Tjiasaka uploaded a tearful TikTok apology for previously endorsing P2P lending – including Akseleran – without highlighting the risks. The video drew almost one million views, 993 comments and 1,100 shares in a day.

Media-monitoring tool Newstensity recorded 88 Akseleran articles between June 1–24; coverage spiked after Felicia’s post and peaked at 17 stories on June 21. Of 63 default-related pieces, more than half mentioned Felicia, showing how a single influencer can drive mainstream attention.

For now, Akseleran says it is pursuing repayments, activating insurance claims and negotiating with borrowers. Retail lenders can only wait.

Indonesia’s P2P industry, once hailed for democratizing credit, risks losing public trust. Without swift reforms and transparent crisis handling, the nation’s vast fintech opportunity may, indeed, wither in an extended winter.

Writer: Khoirul Rifai (jangkara.id), Ilustrator: Aan K. Riyadi

Lately, the term SEAblings has been widely discussed across social media. The phenomenon gained traction after tensions between Southeast Asian…

Lieutenant Colonel Teddy Indra Wijaya, the Cabinet Secretary of the Republic of Indonesia, is currently carrying three major roles at…

The government’s decision to appoint personnel from the Nutrition Fulfillment Service Unit (SPPG) as Government Employees with Work Agreements (PPPK),…

The evolution of marketing over the past few years has shown a major shift, especially as digital marketing becomes the…

Freedom of opinion and expression is a constitutional right protected by law. Today, the public’s channel for voicing disappointment toward…

In January 2026, the internet was shaken by the viral spread of a book titled “Broken Strings: Fragments of a…

The government has begun outlining the direction of the 2026 State Budget (APBN 2026) amid ongoing global economic uncertainty. Finance…

The Indonesian government, through the Ministry of Communication, Information, and Digital Affairs (Komdigi), has officially temporarily blocked the use of…

A few years ago, electric cars still felt like a far-off future. They were seen as expensive, futuristic in design,…

Hydrometeorological disasters hit three provinces in Sumatra—Aceh, North Sumatra, and West Sumatra. Tropical Cyclone Senyar, spinning in the Malacca Strait,…